Are you sure you want to quit the chat?

In today’s dynamic financial markets, successful trading strategies hinge on insightful analysis and predictive modeling. One emerging approach is leveraging ARIMA Financial Forecasting via time series analysis. Here, we delve into how integrating these methods empowers traders to make informed decisions and optimize investment portfolios.

ARIMA models, pioneered by Box and Jenkins in the 1970s, offer a comprehensive framework for analyzing time series data. With components including autoregressive (AR), differencing (I), and moving average (MA), ARIMA Financial Forecasting is well-suited for capturing the intricate temporal relationships observed in financial markets.

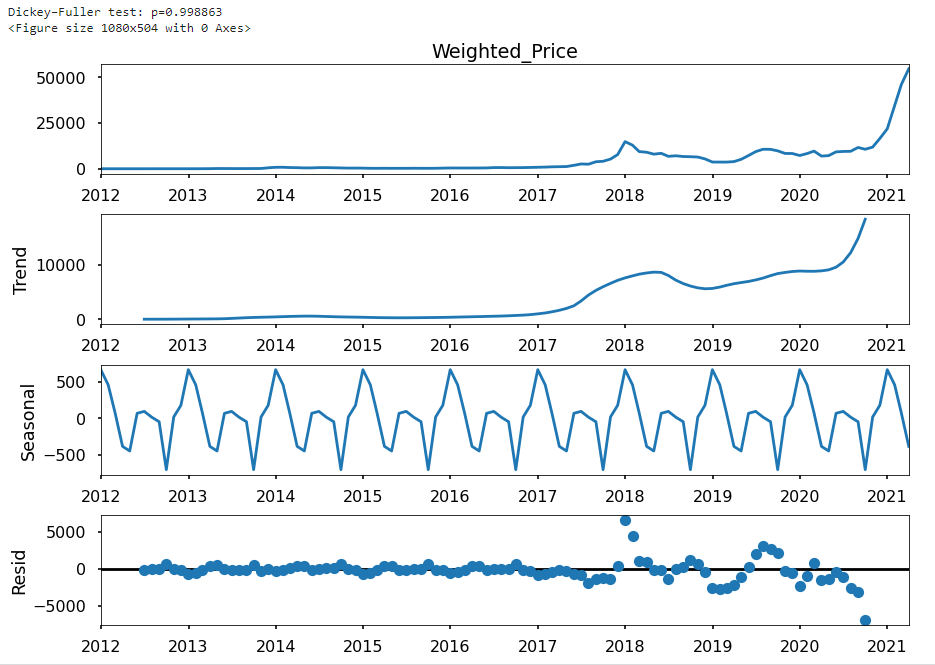

Furthermore, explore the practical application of ARIMA Financial Forecasting models in financial trading, highlighting their effectiveness in capturing trends, seasonality, and volatility in market data. From selecting appropriate model orders to evaluating performance, address challenges and strategies associated with implementing ARIMA in trading environments.

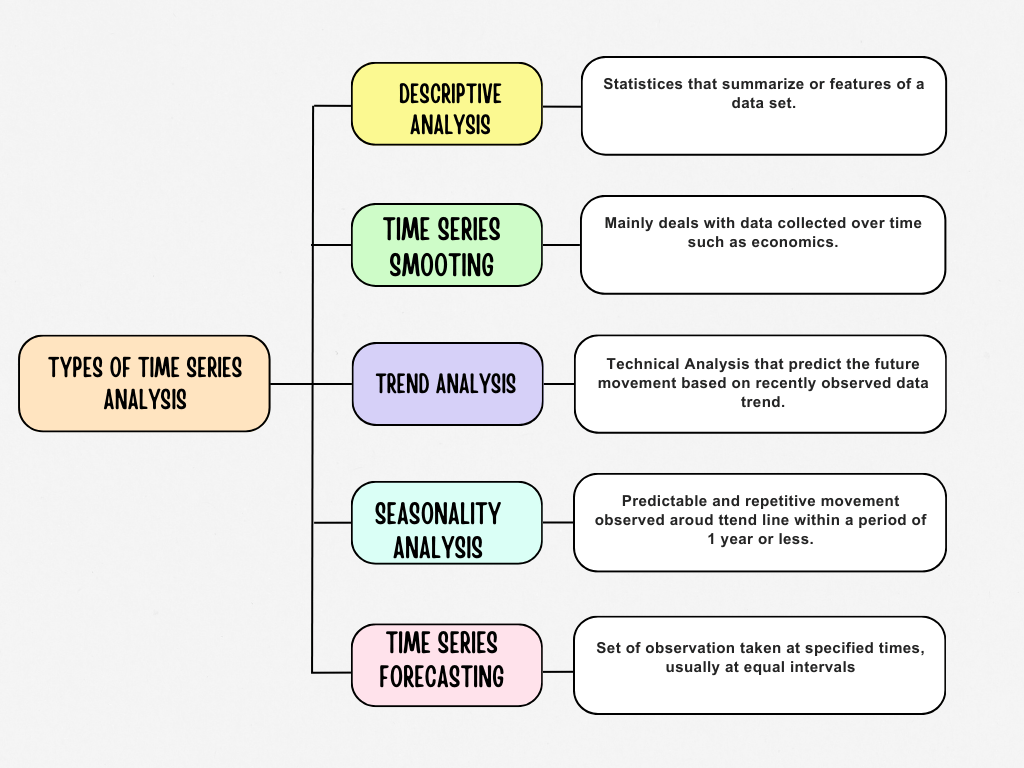

Moreover, Time series analysis forms the core of effective trading strategies, allowing traders to pinpoint patterns, trends, and cyclical fluctuations in market data. Techniques like descriptive analysis, trend analysis, and seasonality analysis yield valuable insights into market dynamics, paving the way for informed decision-making in financial trading.

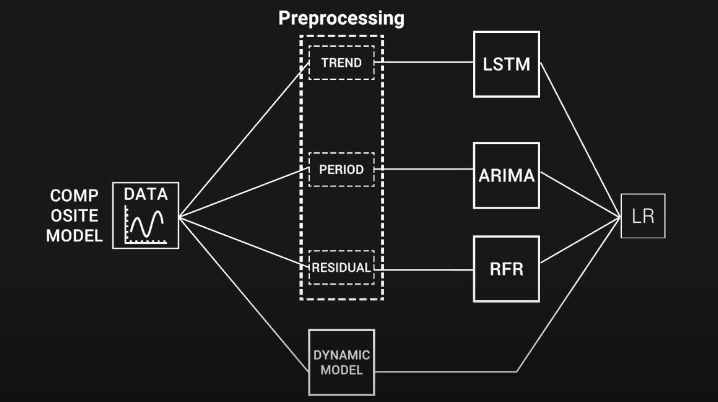

While ARIMA Financial Forecasting models excel in capturing linear patterns, generative artificial intelligence (AI) models like recurrent neural networks (RNNs) offer enhanced flexibility in addressing nonlinear interactions. Here, we compare the strengths and limitations of ARIMA models and generative AI approaches, assisting traders in selecting the most suitable method for their trading objectives.

Successful implementation of ARIMA models in trading strategies necessitates careful consideration of factors like data characteristics, interpretability, computational resources, and data size. By grasping these considerations, traders can customize their approach to effectively harness the predictive power of ARIMA models.

Integrating time series analysis with ARIMA models empowers traders to craft robust trading strategies, bolster decision-making capabilities, and mitigate risks in volatile market conditions. By leveraging insights from time series analysis, traders can optimize investment portfolios and pursue superior returns.

In conclusion, integrating time series analysis with ARIMA Financial Forecasting models provides a potent framework for enhancing financial trading strategies. As a result, by leveraging these analytical tools, traders can gain deeper insights into market dynamics, make informed decisions, and navigate today’s financial markets with confidence and precision.

As part of the deduplication process, we also updated our reference table to reflect old-to-new key mappings. This allowed us to ensure that the correct GUIDs were assigned to the deduplicated records, maintaining the integrity of the data relationships in CRM.

At ITKnocks, we are more than an IT consulting company; we’re your strategic partner in business evolution. With a global footprint and a passion for technology, we craft innovative solutions, ensuring your success. Join us on a journey of excellence, where collaboration meets cutting-edge IT expertise.